Learn Practical Income Tax Course From The Top Industry Experts

80+ Hours, Complete course Updated Learning with

Live Return Filing

Certification Course with Practical Knowledge

The Course covers Income Tax, TDS, ROC & Balance Sheet from Basic to Advanced level covering legal aspects, major compliances, amendments, Sections, precautions to minimize disputes with the Income tax department,

Practical Knowledge

Certificate

Return Filing

Highly Interactive

Time Saving

In depth Knowlwdge

Course

1-Year Validity

Exclusive Early Bird Limited Time Discount

₹6,490 Today

(include GST)

Get this Course with bonuses

Exclusive Free Bonuses When You Order Today

BONUS #1

(₹9,997 Value)

1) Complete Notes by FCA Kapil Jain

- check_circleAll Notes by CA Kapil Jain will help you in better understanding

- check_circleYou can download and take the printout of the same

BONUS #3

(₹10,997 Value)

2) Unlimited Views

- check_circleYou will get Unlimited views on every lecture.

- check_circleNo worry about 2 views, attend lectures as many time as you want

BONUS #5

(₹5,999 Value)

3) Course Completion Certificate

- check_circleAfter completing the course you will get a certificate signed by FCA Kapil Jain From KJ CLASSES

BONUS #6

(Unlimited Value)

4) Access to interactive Query Resolution With CA Kapil Jain

- check_circleImagine you are getting the keys to the kingdom & then if you are ever stuck, you will be guided by none other than Kapil Jain himself. Just attend the live Q&A sessions & ask your queries.

- check_circleThis bonus alone is worth much more than the price of the entire program.

Get This

BONUS #1

Access your Course in any Device

As a special bonus, enjoy full access to the course across all your devices. Whether you prefer learning on your laptop, tablet, or phone, dive into the content seamlessly anytime, anywhere. Explore the course material effortlessly and make the most of your learning experience on any device you choose!

Why Should You Join This Course?

- Mobile, Tab, Laptop and Desktop Access

- No Pen drive and No installations required, Just login & Access

- Hassle Free classes – Click and Play mode

- WhatsApp group access for GST query related to topic

- Recordings of each class will be provided

- Unlimited views of each class with 1 Year Validity

- Participation Certificate

- Updated Soft copies of each Section, Rule, Notification, Circular will be provided

- Charge HIGH give Quality Work to your Client

- ROC Filing/ Provisions of TDS

- All Income Tax Returns (ITR -1/2/3/4)

- Balance sheet Finalization

- Tax deduction/collection at source (TDS/TCS)

- Set off and carry forward

- Income Tax Refund and Notices

- Salary, PGBP, Capital Gain

- Income Tax Theory + Practical Interactive Session

- How to close books of accounts for F.Y 23-24, Etc.

- PDF Notes, Computation sheets, Charts & Formats

- Self Assessment & Computation

- Deductions, Exemptions & Reliefs

- CP Gram Filed against Govt Dept.

Meet your Instructor

FCA Kapil Jain

FCA (Fellow Chartered Accountant)

Course Content

Income Tax, TDS, ROC & Balance Sheet

- Basic of Income Tax

- Advance Tax

- TDS

- Income Tax

- TDS-1

- TDS & House property tax

- Balance Sheet

- Balance Sheet 1

- Income tax forms AY 2023-24

- 44 AD ADA AB

- House Property Tax

- Deducations- Part-1

- Deducations- Part-2

- Capital Gain

- Income tax forms AY 2020-21

- AOC Form

- Income tax forms AY 2020-21(Form 5 to 7)

- Income Tax_TCS

- ROC

- ROC_MGT-7

- ROC_Director Appointment

- Income tax Latest Changes

- Balance Finalization

- TDS & TCS

- ITR-1 & ITR-4

- TDS & TDS ALL SEC

- ITR-4 & BSF

Who can attend this Complete GST Certification Course?

Professionals

Finance professionals like CA/CS/CMA/Lawyers who deal in taxation to meet their professional needs.

Finance Person

Professionals who want to shift from finance to Taxation domain.

Business

Business Heads, Business Owners, CEO, CFO, Finance Directors, Tax Directors, Analysts, Department Heads and Project Heads

Tax practitioners

GST Practitioners and Income Tax Practitioners.

Beginners

Individuals/beginners seeking career opportunities in the taxation domain.

Officers

SMEs, Traders, Tax Officials, Finance and Accounts Officers,

B.com

B. com aspirants who want to learn GST practically

LLB

LLB practitioners and aspirants

Commerce

Students & Accountant

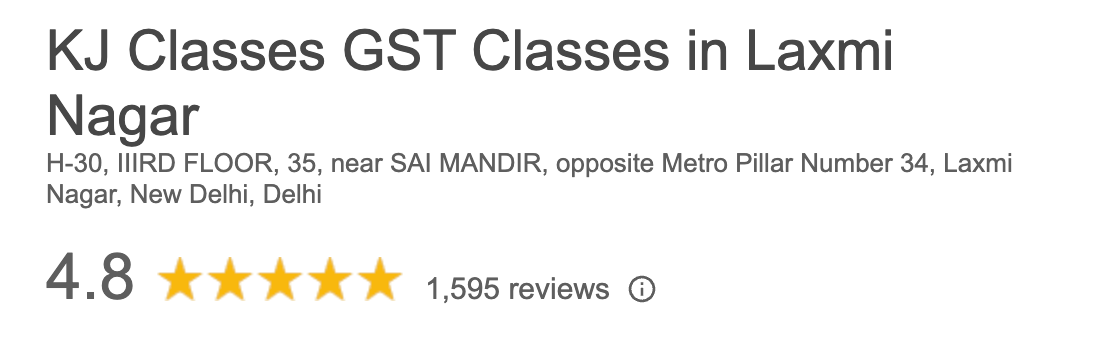

1500+

Google Review

98k+

Students

100%

Success Rate

200K

YouTube Family

Get It Now

This Income Tax (ITR) & TDS course contains a complete & detailed analysis with practical examples. All the relevant amendments up to Finance Act 2022 are covered in this course. The student will also get the detailed Study Notes, along with case studies.

Certificate from KJ Classes Signed by FCA Kapil Jain also be given after the completion of course.

The batch will be delivered by FCA Kapil Jain, who has trained more than 20,000 professionals across India. He is a well-known Taxation Expert and National Level Eminent Speaker in seminars and workshops on Taxation

All rights are reserved |100% Satisfaction Guaranteed | We Protect Your Privacy

Marketed By:Digital Market AddA