Completely Practical GST Course with Law

One Year Validity + Unlimited Views

65 Hours, On-Demand Updated Step-by-Step

Effortless Learning by CA Kapil Jain with

Real Clients Live Return Filing

Offer Ends In :

Exclusive Limited Time Discount ₹20,000 ₹15,000₹5900 Today

(include GST)

All About

GOODS AND SERVICES TAX

- (CGST Law / IGST Law with Rules and Form)

- GST Act 2017+Rules + Amendment

- Live Return Filing

- How to File Appeal

- All GST Compliances

- Reply Notices & Drafting

- Dealing with GST Department

- Give Consultation with proper Knowledge

- Give Consultation with proper Knowledge

- How to claim the past 1 year of ITC while Registration.

- Charge HIGH give Quality Work to your Client

- ITC / Refund, GSTR-9 & 9C, TDS/TCS

- Tax Invoice, E-Invoicing & E-Way Bill

The Course covers full GST from Basic to Medium level covering legal aspects, major compliances, amendments, Sections, precautions to minimize disputes with the GST department, Handling assessments, GST Health Check-up, along with case studies.

All About

GOODS AND SERVICES TAX

- (CGST Law / IGST Law with Rules and Form)

- GST Act 2017+Rules + Amendment

- Live Return Filing

- How to File Appeal

- All GST Compliances

- Reply Notices & Drafting

- Dealing with GST Department

- Give Consultation with proper Knowledge

- Give Consultation with proper Knowledge

- How to claim the past 1 year of ITC while Registration.

- Charge HIGH give Quality Work to your Client

- ITC / Refund, GSTR-9 & 9C, TDS/TCS

- Tax Invoice, E-Invoicing & E-Way Bill

The Course covers full GST from Basic to Medium level covering legal aspects, major compliances, amendments, Sections, precautions to minimize disputes with the GST department, Handling assessments, GST Health Check-up, along with case studies.

Get this Course with bonuses

FAST ACTION BONUSES

BONUS #1

Access your Course in any Device (Worth ₹6,000)

As a special bonus, enjoy full access to the course across all your devices. Whether you prefer learning on your laptop, tablet, or phone, dive into the content seamlessly anytime, anywhere. Explore the course material effortlessly and make the most of your learning experience on any device you choose!

Why Should You Join This Course?

- Mobile and Desktop access available

- No Pen drive and installations required

- Hassle Free classes – Click and Play mode

- WhatsApp group access for GST query related to topic

- Unlimited views of each class with 1 Year Validity

- Participation Certificate

- Practical Filing of GST Returns in Portal

- How to file appeal in GST

Demo Lecture

- 65 Hours course -

Who can attend this Complete GST Certification Course?

Professionals

Finance professionals like CA/CS/CMA/Lawyers who deal in taxation to meet their professional needs.

Finance Person

Professionals who want to shift from finance to Taxation domain.

Business

Business Heads, Business Owners, CEO, CFO, Finance Directors, Tax Directors, Analysts, Department Heads and Project Heads

Tax practitioners

GST Practitioners and Income Tax Practitioners.

Beginners

Individuals/beginners seeking career opportunities in the taxation domain.

Officers

SMEs, Traders, Tax Officials, Finance and Accounts Officers,

B.com

B. com aspirants who want to learn GST practically

LLB

LLB practitioners and aspirants

Commerce

Students & Accountant

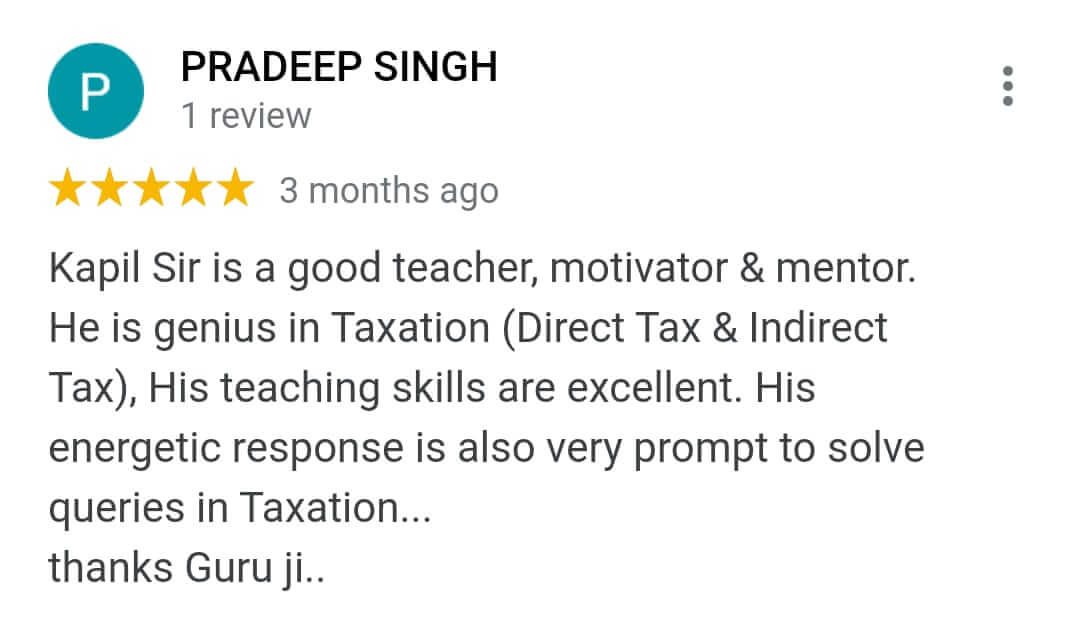

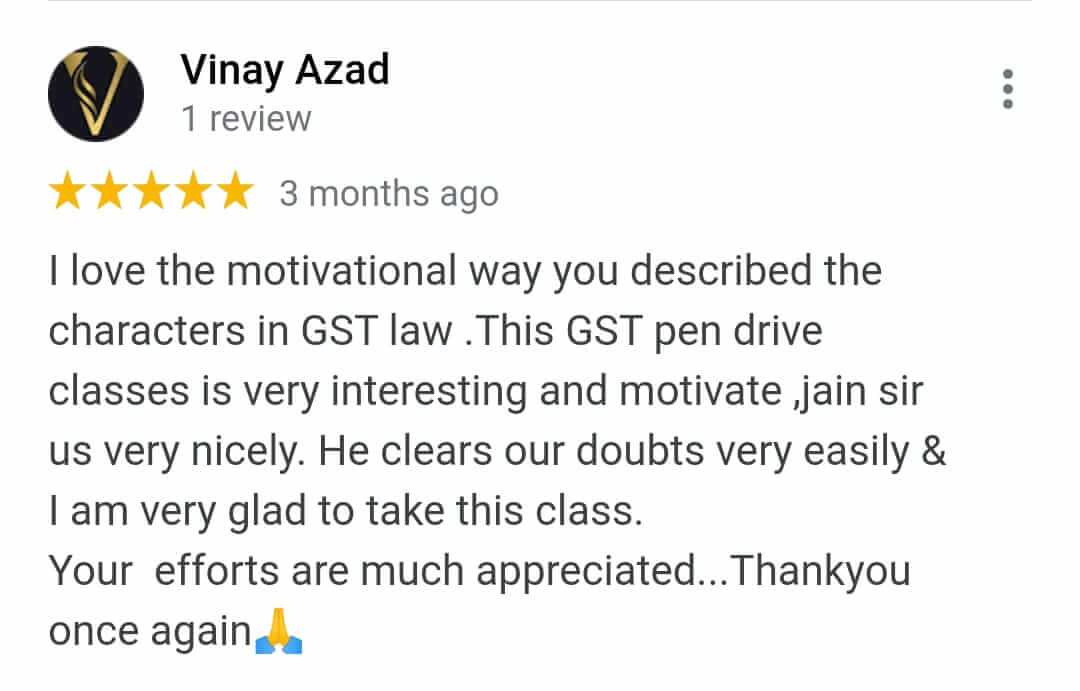

Meet your Instructor

FCA Kapil Jain

FCA (Fellow Chartered Accountant)

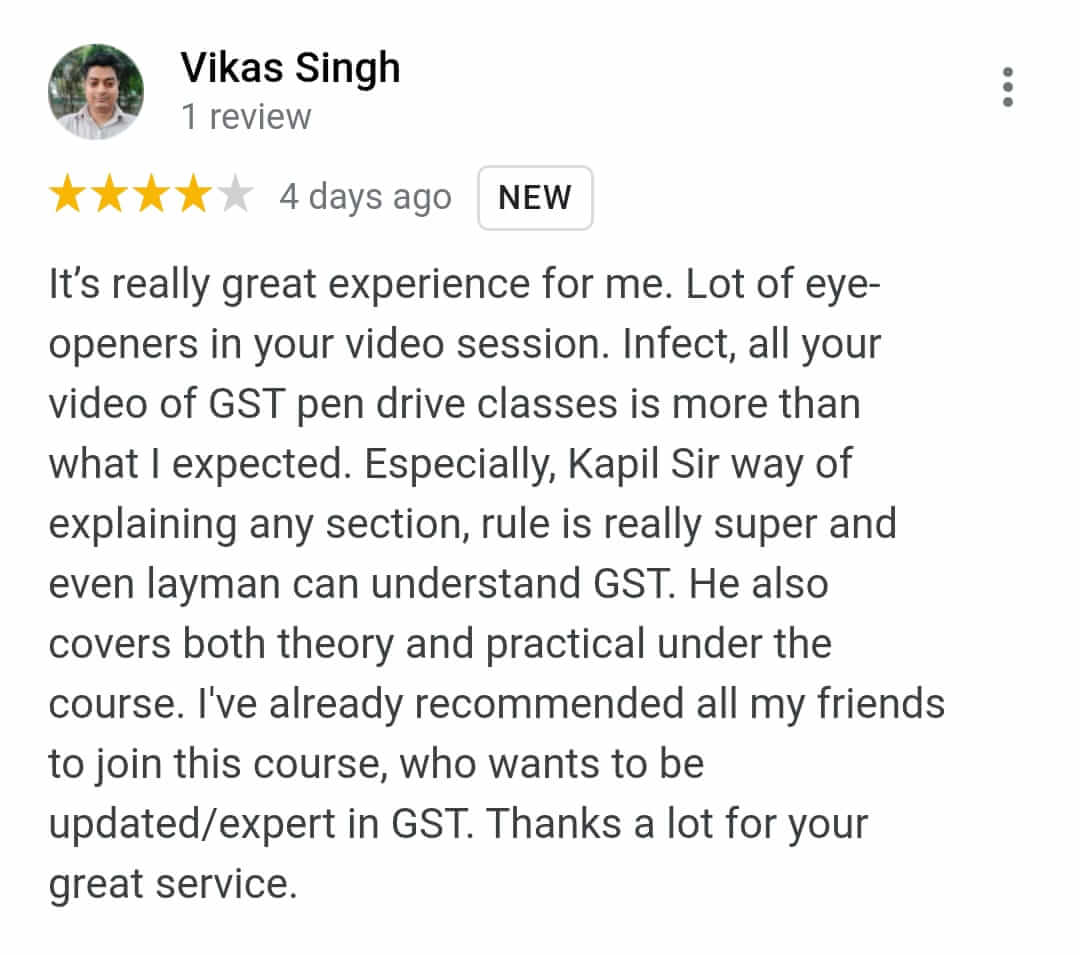

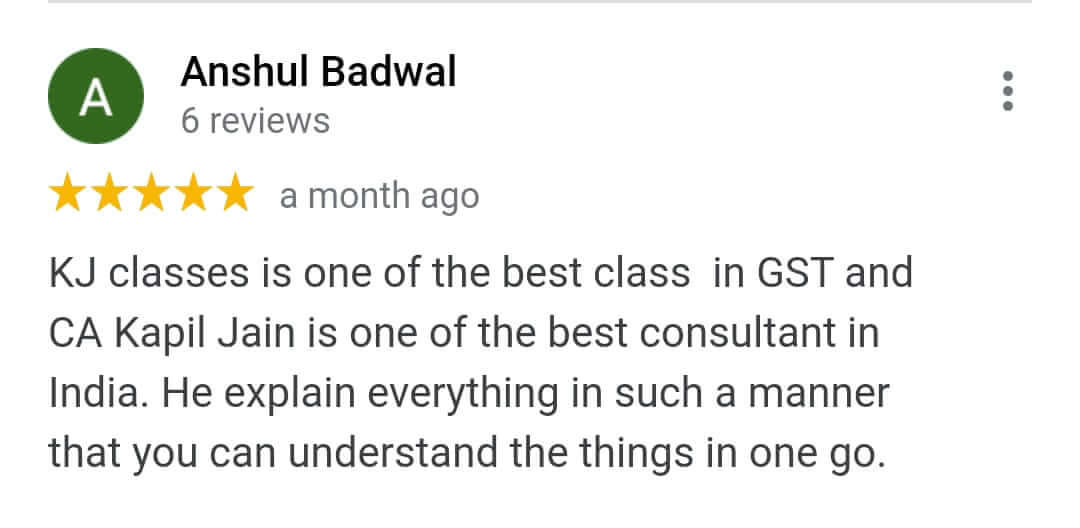

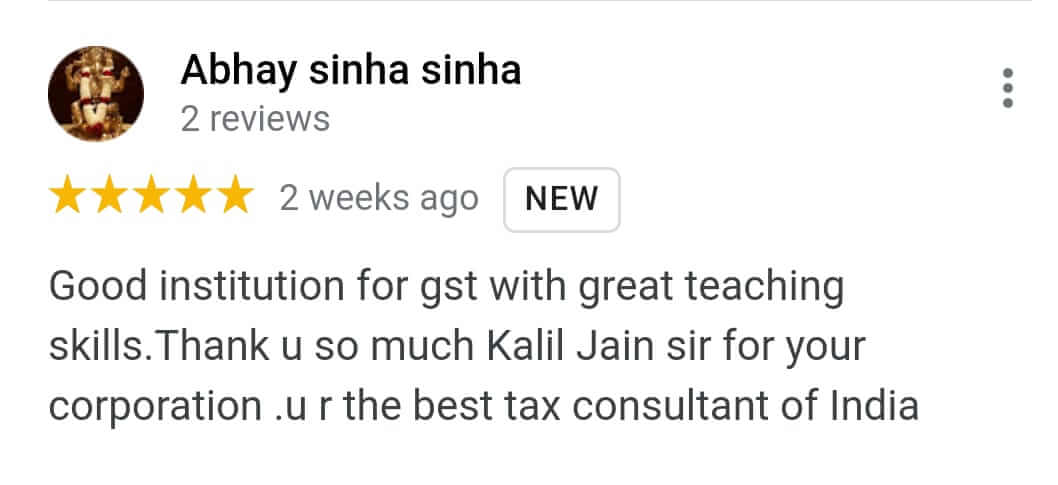

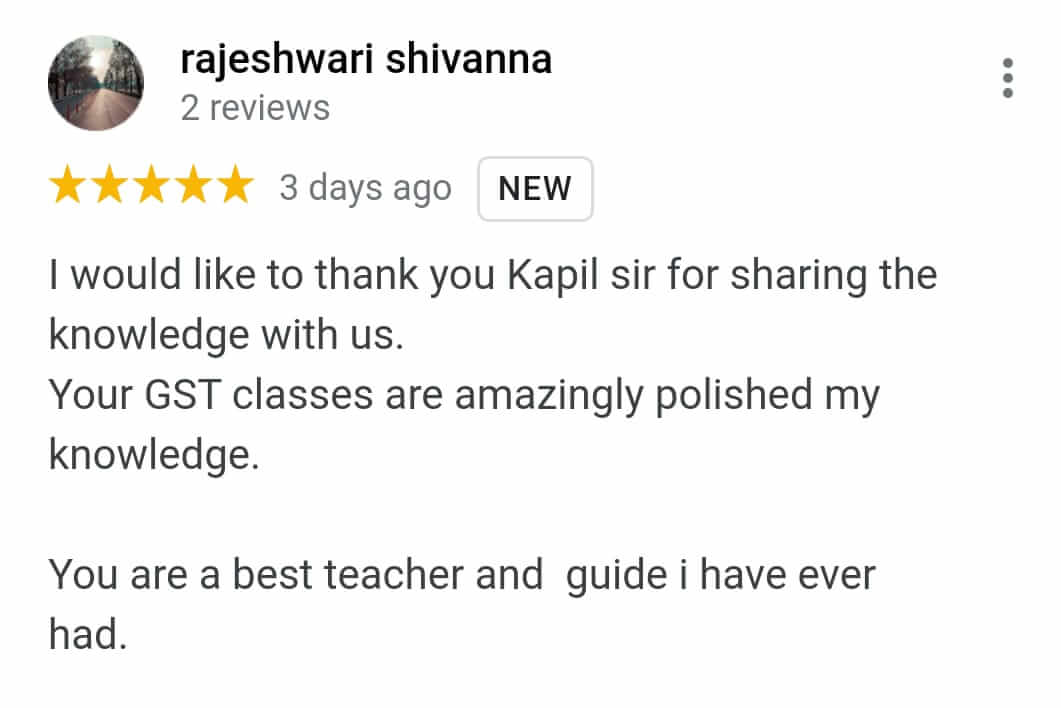

1600+

Google Review

98k+

Students

100%

Success Rate

200K

YouTube Family

All rights are reserved |100% Satisfaction Guaranteed | We Protect Your Privacy

Marketed By:Digital Market AddA