New Year sale apply coupon "New2024" Get 15% Extra Discount

(Arjun Batch)Live GST Course Practical with Law

Become Professional GST Expert

From 7th Jan 2024, Every Sunday 03:00 pm to 06:00 pm

Get Recordings of your Classes with

One Year Validity + Unlimited Views

180 Hours, In-Depth, On-Demand Updated Step-by-Step

Effortless Learning by CA Kapil Jain with

Real Clients Live Return Filing

The Most Comprehensive Course

Offer Ends In :

Exclusive Limited Time Discount

(71% OFF Discount Coupon Pre-Applied) ₹30,000 ₹15,000₹8,723 Today

(include GST)

All About

GOODS AND SERVICES TAX

- (CGST Law / IGST Law with Rules and Form)

- GST Act 2017+Rules + Amendment

- Live Return Filing

- How to File Appeal

- All GST Compliances

- Reply Notices & Drafting

- Dealing with GST Department

- GST Latest Council Meetings

- Stay Updated with amendments and Notifications

- Give Consultation with proper Knowledge

- How to claim the past 1 year of ITC while Registration.

- Charge HIGH give Quality Work to your Client

- ITC / Refund, GSTR-9 & 9C, TDS/TCS

- Audit & Assessment

- Tax Invoice, E-Invoicing & E-Way Bill

The Course covers full GST from Basic to Advanced level covering legal aspects, major compliances, amendments, Sections, precautions to minimize disputes with the GST department, Handling assessments, GST Health Check-up, along with case studies.

All About

GOODS AND SERVICES TAX

- (CGST Law / IGST Law with Rules and Form)

- GST Act 2017+Rules + Amendment

- Live Return Filing

- How to File Appeal

- All GST Compliances

- Reply Notices & Drafting

- Dealing with GST Department

- GST Latest Council Meetings

- Stay Updated with amendments and Notifications

- Give Consultation with proper Knowledge

- How to claim the past 1 year of ITC while Registration.

- Charge HIGH give Quality Work to your Client

- ITC / Refund, GSTR-9 & 9C, TDS/TCS

- Audit & Assessment

- Tax Invoice, E-Invoicing & E-Way Bill

The Course covers full GST from Basic to Advanced level covering legal aspects, major compliances, amendments, Sections, precautions to minimize disputes with the GST department, Handling assessments, GST Health Check-up, along with case studies.

Get this Course with bonuses

Exclusive Free Bonuses When You Order Today

BONUS #1

(₹9,997 Value)

1) Complete Notes by FCA Kapil Jain

- check_circleAll Notes by CA Kapil Jain will help you in better understanding

- check_circleYou can download and take the printout of the same

BONUS #2

(₹10,997 Value)

2) Updates on all Amendments & Notifications

- check_circleYou will receive updates on all Amendments & notification updates with your course

- check_circle1-Year free of cost updates

- check_circleSo you don’t need to worry about Amendments and Notifications

BONUS #3

(₹10,997 Value)

3) Unlimited Views

- check_circleYou will get Unlimited views on every lecture.

- check_circleNo worry about 2 views, attend lectures as many time as you want

BONUS #4

(₹10,997 Value)

4) Access to Online Community

- check_circleOur online community is a great place to build connections and get answers to your queries in real-time.

- check_circleGrow your network with professionals

- check_circleInteractive Q&A

BONUS #5

(₹5,999 Value)

5) Course Completion Certificate

- check_circleAfter completing the course you will get a certificate signed by FCA Kapil Jain From KJ CLASSES

BONUS #6

(₹16,699 Value)

6) Our all paid webinar's recording free of cost

- check_circleYou will receive all the recording with your course by email

- check_circleYou don't need to pay anything extra for our webinar's recording

BONUS #7

(Unlimited Value)

7) Access to interactive Query Resolution With CA Kapil Jain

- check_circleKapil Jain is so committed for the success of his members that he does Q&A live session where he answers all the queries asked by the live attendees.

- check_circleImagine you are getting the keys to the kingdom & then if you are ever stuck, you will be guided by none other than Kapil Jain himself. Just attend the live Q&A sessions & ask your queries.

- check_circleThis bonus alone is worth much more than the price of the entire program.

FAST ACTION BONUSES

BONUS #1

Access your Course in any Device (Worth ₹6,000)

As a special bonus, enjoy full access to the course across all your devices. Whether you prefer learning on your laptop, tablet, or phone, dive into the content seamlessly anytime, anywhere. Explore the course material effortlessly and make the most of your learning experience on any device you choose!

Why Should You Join This Course?

- Mobile and Desktop access available

- No Pen drive and installations required

- Hassle Free classes – Click and Play mode

- WhatsApp group access for GST query related to topic

- Recordings of each class will be provided

- Unlimited views of each class with 1 Year Validity

- Participation Certificate

- Updated Soft copies of each Section, Rule, Notification, Circular will be provided

- Linking of one provision with other for better understanding

- Practical Filing of GST Returns in Portal

- Special Coverage on E-Commerce, OIDAR, Services

- Special Coverage of Real Estate Transactions in GST

- Special Coverage of PSLC Concept in GST

- Hotel Industry, GTA industry

- Education industry, Health industry

- Important exemption one by one

- Special Points will be discussed in GST Provisions

- Points to be noted for GST Notice reply

- How to file appeal in GST

- How to make E-way bill Live Demi in GST Portal

- Explanation of RCM Entries and its applicability

- Table wise explanation of GSTR3B, GSTR1, IFF, GSTR-9, GSTR-9C in GST Portal

Demo Lecture

- 180 Hours Complete course -

Who can attend this Complete GST Certification Course?

Professionals

Finance professionals like CA/CS/CMA/Lawyers who deal in taxation to meet their professional needs.

Finance Person

Professionals who want to shift from finance to Taxation domain.

Business

Business Heads, Business Owners, CEO, CFO, Finance Directors, Tax Directors, Analysts, Department Heads and Project Heads

Tax practitioners

GST Practitioners and Income Tax Practitioners.

Beginners

Individuals/beginners seeking career opportunities in the taxation domain.

Officers

SMEs, Traders, Tax Officials, Finance and Accounts Officers,

B.com

B. com aspirants who want to learn GST practically

LLB

LLB practitioners and aspirants

Commerce

Students & Accountant

Meet your Instructor

FCA Kapil Jain

FCA (Fellow Chartered Accountant)

Course Learning

Here is What You Will Learn Inside

The GST Course

Learning: 1

Intro & Welcome

- Concept of GST in India

- Need for GST in India

- Framework of GST

- GST Council

Learning: 2

Supply under GST

- Concept of supply

- Composite and mixed Supply

- Taxability of composite & mixed Supply

Learning: 3

Charge of GST

- Extend & Commencement of GST

- Charge of GST

- Levy & collection of GST

- GST on e-commerce

Learning: 4

Composition Levy in GST

- Composition levy for traders & manufacturer

- Composition levy for restaurant services

- Composition levy for other services

Learning: 5

RCM in GST

- RCM on goods

- RCM on Services

- RCM from unregistered purchase

Learning: 6

Exempt Supply in GSTExempt Supply in GST

- Exemptions of goods from GST

- Exemption of services from GST

Learning: 7

Time of Supply in GST

- TOS in case of Goods

- TOS in case of Services

- TOS in the case of RCM

Learning: 8

Value of Supply in GST

- Calculation of value of goods and services in GST

- Valuation Rules for goods and services

Learning: 9

Place of Supply in GST

- POS of goods within India

- POS of services within India

- POS of goods outside India

- POS of services outside India

Learning: 10

Input Tax Credit in GST

- Concept ITC in GST?

- Sec 16 Eligibility & Conditions for ITC

- Clause (aa) of sec 16(1) added by FA 2021

- Summary of sec 16

- Sec 17 apportionment & Block Credits

- Sec 17(5) Block Credits in GST

- Rule 42 apportionment of input & input services

- Rule 43 apportionment of capital goods

- Sec 18 ITC in special circumstances

- Sec 18(1)(a) ITC availment in case of mandatory registration

- Sec 18(1)(b) ITC availment in case of voluntarily registration

- Sec 18(1)(c) ITC availment from composite levy to regular

- Sec 18(1)(d) ITC availment from exempt to taxable supply

- ITC Forms in GST

- Remaining provisions of sec 18

- Sec 18(6) Supply of capital goods or plant and machinery

- Sec 19 ITC on input or capital goods on goods send for Job work

- Sec 20 ITC distribution by ISD

- Recovery of ITC from ISD

- List of sections and rules related to ITC

- Manner and utilisation of ITC

- Rule 86A Condition of use of electronic credit ledger

- Rule 86B Restriction on the use of electronic credit ledger

- How scams and bill trading happen in GST

Learning: 11

Tax Invoice, Debit Note & Credit Note in GST

- Tax Invoice provisions and rules

- Debit note and Credit note provisions

- e-invoicing

Learning: 12

Registration in GST

- Concept of the taxable person

- Person liable for GST registration

- Procedure for registration

- Cancellation of registration

- Practical session on GST Registration

- Documents required for GST Registration

Learning: 13

Refund in GST

- identify the situations leading to refund claim

- explain the time limit for claiming a refund and the concept of a ‘relevant date’ to calculate such time limit

- identify the conditions to be satisfied and documents to be filed to claim the refund in different circumstances

- illustrate the circumstances under which the Department may withhold a refund claim

- explain the ‘principle of unjust enrichment

- describe the provisions relating to the ‘Consumer Welfare Fund’.

- explain provisions relating to refunds to UN Bodies, Embassies, etc.

- explain the provisions relating to refunds to the retail outlets established in departure area of an international airport

- compute the interest payable to the applicant on delayed refunds

Learning: 14

Assessment & Audit in GST

- Self-assessment in GST

- Provisional assessment in GST

- Scrutiny of returns

- Assessment of non-filers of GST returns

- Assessment of the unregistered person

- Summary assessment in GST

- Audit by authorities

- Special Audit

Learning: 15

Inspection, Search and Seizure in GST

- Power of inspection, search & seizure

- inspection of goods in movement

- Power to arrest

- Power to summon

- Access to business premises

- Officers to assist proper officers

Learning: 16

Demand & Recovery in GST

- Determination of Tax under section 73

- Determination of Tax under section 74

- Tax collected but not deposited

- Recovery proceedings

- Transfer of property to be void

- Tax to first charge on property

- Provisional attachment to protect revenue interest

Learning: 17

Appeal in GST

- Appeals to Appellant Authority

- Powers of Revisional Authority

- Appellant tribunal under GST

- Mandatory deposit of pre-deposit

- Procedure of additional evidence before Appellant Authority

- Appeal to High Court

- Appeal to Supreme Court

- Appeal not to be file in certain cases

Learning: 18

Advance Ruling in GST

- Question for which Advance ruling can be sought

- AAR and AAAR

- Procedure for obtain Advance Ruling

- Rectification of mistake

- Advance ruling to be void in certain cases

Learning: 19

Types of Returns in GST

- Overview of GSTR 1

- Overview of GSTR 2A

- Overview of GSTR 2B

- Difference between GSTR 2A and 2B

- Overview GSTR 3B

- Overview of GSTR 4

- Overview of CMP 08

- Overview of GSTR 5

- Overview of GSTR 6

- Overview of GSTR 7

- Overview of GSTR 8

- Overview of GSTR 9 (Annual Return)

- Overview of GSTR 9C

- Overview of GSTR 10 (Final Return)

Learning: 20

Practical Session on GST Portal

- Overview of GST Portal

- How to search HSN Code?

- How to verify GSTIN?

Learning: 21

Practical session on IFF

- FAQ on IFF Filing

- Understand the IFF Tables

- Filing of IFF

Learning: 22

Practical session on ITC Reconciliation

- How to arrange data

- Using Excel for Reconciliation

- Identify the default supplier in Excel

- Follow up with suppliers

Learning: 23

Practical session on GSTR 2A and GSTR 2B

- Understand tables of GSTR 2A Statement

- Understand tables of GSTR 2B Statement

- Difference between GSTR 2A & GSTR 2B

- Analysis of GSTR 2A & GSTR 2B on GST Portal

Learning: 24

Practical sessions on GSTR 1

- Understand Tables of GSTR 1

- How to enter B2B supply in GSTR 1

- How to enter B2C supply in GSTR 1

- How to enter debit note and credit note

- How to enter export invoices

- HSN-wise reporting in GSTR 1

- Document-wise reporting in GSTR 1

- Use of offline tool for GSTR 1 Filing

- Prepare JSON file for offline GSTR 1 Filing

- Errors in JSON preparation

- Filing of GSTR 1

Learning: 25

Practical session on GSTR 3B (Regular)

- Understand Tables of GSTR 3B

- Supplies to be enter under table 3.1

- Supplies to be enter under table 3.2

- ITC to be claim in table 4

- Reversal of ITC in GSTR 3B

- Challan preparation and payment on GST Portal

- Setoff GST liability

- Filing of GSTR 3B

Learning: 26

Practical session on GSTR 3B (QRMP)

- Points to remember for quarterly 3B

- Understand Tables of GSTR 3B

- Supplies to be enter under table 3.1

- Supplies to be enter under table 3.2

- ITC to be claim in table 4

- Reversal of ITC in GSTR 3B

- Challan preparation and payment on GST Portal

- Setoff GST liability

- Filing of GSTR 3B Quarterly

Learning: 27

Practical session on GST Computation

- Learn to prepare data for GST Filing

- Use of Excel for data preparation

- Classification of taxable, zero rated and exempt supply

- Classification of eligible and ineligible ITC

- ITC set off provisions and its application in computation

- Application of Rule 36(4)

- Mapping GSTR 2B and Book ITC data

- Finalizing data for GST Returns

Learning: 28

Practical session on GSTR 9

- Understand applicability of GSTR 9

- Understand time limit to file GSTR 9

- Data required to file GSTR 9

- Understand all tables of GSTR 9

- Adjustments required in GSTR 9

- Payment of Tax through DRC 03

- Filing of GSTR 9

- HSN Summary reporting in GSTR 9

- Table 6 & Table 8 Reco in GSTR 9

- Practical issues in GSTR 9 Filing

Learning: 29

Practical session on GSTR 9C

- Understand applicability of GSTR 9C

- Self Certification update by FA 2021

- Documents required to file GSTR 9C

- Points to be reconcile in GSTR 9C

- Difference between Gross Turnover and Taxable Turnover

- Payment of unreconciled amount through DRC 03

- Filing of GSTR 9C along with balance sheet and PnL

Learning: 30

Practical session on GSTR 10

- Filing application for GST Cancellation GST REG 16

- Time limit for approval of application

- Filing of GSTR 10

Learning: 31

Practical session on e invoicing

- Intro to e invoice

- GePP Tool for generating e invoice

- Overview and limitation of GePP tool for e invoicing

- Add Supplier Master in GePP tool

- Add Recipient Master in GePP tool

- Add Product Master in GePP tool

- Filing Data for e invoicing in GePP tool

- Generating JSON file from GePP tool

- How to generate IRN and e invoicing

- How to cancel e invoice

- Time limit for canceling e invoice

- Bulk e invoice generation Format A

- Bulk e invoice generation Format B

- Bulk e invoice generation Format C

- Bulk e invoice generation Format D

- Generating Bulk e invoice through Format A

- Validating and Preparing JSON in Form A for e invoicing

- Bulk e invoicing cancellation

Course Content

MODULE 1

BASIC OF GST (SECTION 1, 2, 9(3), (4), (5), 10))

♦Short, Title & Commencement (Section 1)

♦Important Definitions. (Section 2)

♦Constitution Background (Constitution Amendment Act)

♦Charging Section (Section 9)

♦Reverse Charge (Section 9 (3), (4), (5))

♦Composition Scheme (Section 10)

♦Exemptions (Section 11)

♦GST Compensation Cess

MODULE 2

GST REGISTRATION (SECTION 22-30, RULES 08-26, FORMS 1-30)

♦Online Registration in GST. (Section 25)

♦ GST REG-01- Application.

♦GST REG-02- Acknowledgement.

♦GST REG-06- Certificate.

♦Persons required to be registered. (Section 22 & 24)

♦Persons Not Liable to be registered. (Section 23 with Notifications)

♦Deemed Registration. (Section 26)

♦Casual Taxable Person. (Section 27)

♦Amendment in Registration. (Section-28)

♦Cancellation of Registration. (Section-29)

♦Revocation of Registration. (Section-30)

MODULE 3

RETURNS UNDER GST SECTION (37-48) RULES (59-84) & FORMS GSTR-1, GSTR-3B, QRMP SCHEME, IFF (INVOICE FURNISHING FACILITY)

♦Online Filing of Various Return Form on Original Client Data

i.e. GSTR-I, IFF, GSTR-3B, GSTR-4, and Annual Return (GSTR-9, GSTR-9A, GSTR-9C) Types of Returns. (Annual Return, First Return, Final Return)

♦ GSTR-1, IFF (Section 37)

♦ GSTR-3B, GSTR-4, (Section 39)

♦ First Return (Section 40)

♦Notice to Return Defaulters. (Section 46)

♦Levy of Late Fee. (Section 47)

♦Goods and Services Tax Practitioners. (Section 48)

MODULE 4

INPUT TAX CREDIT --SECTION (16-21) WITH GST RULES

♦Eligibility & Conditions for taking ITC (Section-16)

♦Block Credit (Section-17)

♦Availability of Credit in Special Cases (Section-18)

♦Online Application of ITC Forms (ITC-01 to ITC-04)

♦ITC for Job Work (Section-19)

♦ITC Distribution by ISD (section-20)

MODULE 6

TAX INVOICE, ACCOUNTS & RECORDS (SECTION 31-36) WITH GST RULES

♦Tax Invoices & E-Invoicing (Section 31)

♦Registered Person can Issue Tax Invoice (Section 32)

♦Tax should be mentioned on the Tax Invoice (Section 33)

♦Credit and Debit Invoice (Section 34)

♦Accounts & Records Maintain (Section 35)

♦Period of Retention (Section 36)

♦Taxation of International Tourist (Section 15, IGST)

MODULE 7

PAYMENT OF TAX AND INTEREST

(SECTION 49-50) WITH GST RULES

♦Payment of Tax, Interest, Penalty and other charges (Section 49)

♦Interest on delayed payment of tax (Section 50)

MODULE 8

SUPPLY, TIME OF SUPPLY, VALUE OF SUPPLY

♦Meaning of Supply (Section-7) With Schedule I, II, III

♦Composite and Mixed Supply (Section -8)

♦Place of Supply of Goods and Services (Section 10-14 of IGST)

♦Value of Supply (Section 15 with Rules)

♦Time of Supply (Section 13-14)

♦Determination of Nature of Supply (Inter-State or Intra State) (Section 7-9)(IGST)

♦Zero Rated Supply (Section 16)(IGST)

MODULE 9

REFUNDS (SECTION 54-58) WITH GST RULES

- Online Application of GST Refund.

- Refund of Tax (Section-54)

- Refund in Certain Cases (Section-55)

- Interest on Delayed Refunds (Section-56)

- Consumer Welfare Fund (Section-57)

- Utilization of Fund (Section-58)

MODULE 10

TDS & ELECTRONIC COMMERCE IN GST (SECTION 51&52)

- Tax Deduction at source (Section 51)

- Collect of Tax at Source – E-Commerce (Section 52)

MODULE 11

AUDIT {SECTION 65, 66)

♦Audit (Section 65)

♦Special Audit (Section 66)

MODULE 12

E-WAY BILL {SECTION 68,129,130 READ WITH RULES)

♦E-Way Bill Theory and Practical

♦Inspection of Goods in Movement (Section 68 read with Rules)

♦Detention, seizure and release of goods and conveyance in transit (Section 129)

♦Confiscation of goods or conveyances and levy of Penalty (Section 130)

MODULE 13

ASSESSMENT {SECTION 59-64)

♦Self-Assessment (Sec-59)

♦Provisional Assessment (Sec-60)

♦Scrutiny of Returns (Sec-61)

♦Assessment of Non-Filers of Returns (Sec-62)

♦Assessment of unregistered Person (Sec-63)

♦Summary Assessment in Certain Special Cases (Sec-64)

MODULE 14

SUMMON ISSUED BY GST DEPARTMENT & HOW TO HANDLE SUMMON {SECTION 70)

♦Power to summon persons to give evidence and produce documents (Sec-70)

Click Here to Get AccessMODULE 15

DEMAND AND RECOVERY {SECTION 73-76 & 79 & 79)

♦Determination of Tax not Paid or Short Paid/ITC Wrongly availed by other than Fraud (Sec-73)

♦Determination of Tax not paid or Short Paid/ITC Wrongly Availed by Fraud (Sec-74)

♦General Provisions relating to Determination of Tax (Sec-76)

♦Initiation of recovery proceedings. (If not paid Tax within 3 Months of Order) (Sec-78)

♦Recovery of Tax (Sec-79)

MODULE 16

ADVANCE RULING {SECTION 95-97)

♦Definitions of Advance Ruling (Sec-95)

♦Authority for Advance Ruling (Sec-96)

♦Application for Advance Ruling (Sec-97)

MODULE 17

HOW TO REPLY NOTICE & HOW TO FILE APPEAL

♦Appeals to Appellate Authority (Sec-107)

♦How to Reply Notice

♦Offences & Penalties (Section 122)

♦General penalty | Section 125

♦General disciplines related to penalty | Section 126

MODULE 18

CGST Rules 2017 (Amended as on Nov 2023)

Chapter 1 – Preliminary - Rules (1 -2)

Chapter 2 – Composition Rules (3-7)

Chapter 3 – Registration Rules (8-26)

Chapter 4 – Valuation Rules Rules (27-35)

Chapter 5 – Input Tax Credit Rules (36-45)

Chapter 6 – Tax Invoice, D/C notes Rules (46-55A)

Chapter 7 - Accounts and Records Rules (56-58)

Chapter 8 – GST Returns Rules (59-84)

Chapter 9 – Payment of Tax Rules (85-88C)

Chapter 10 – Refunds in GST Rules (89-97A)

Chapter 11 – Assessments in GST Rules (98-102)

Chapter 12 – Advance Ruling Rules (103-107A)

Chapter 13 – Appeals and Revision Rules (108-116)

Chapter 14 – E Way Rules Rules (138-138E)

Chapter 15 – Demand and Recovery Rules (142-161)

Chapter 16 - Penalties in GST Rules (162)

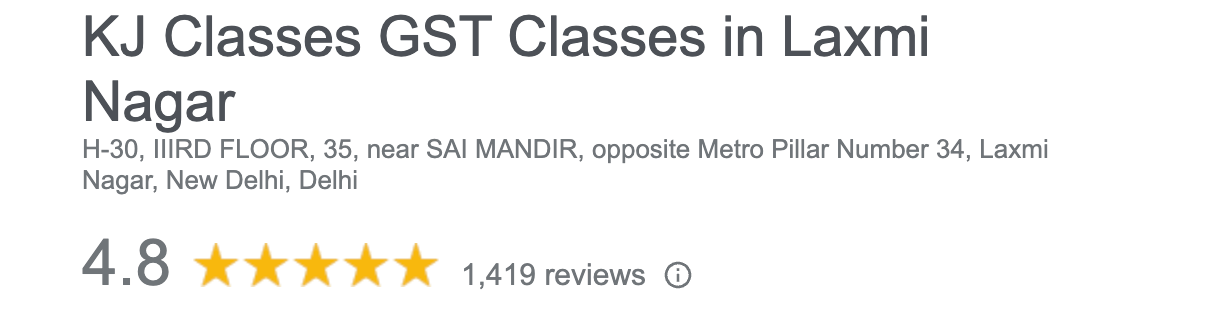

1500+

Google Review

98k+

Students

100%

Success Rate

195K

YouTube Family

Get Started With Your GST Profesional Expert Journey.

Choose Your Favourite Plan Today!

Basic

₹7499

Money saving

- checkDesktop access you can access your course in Desktop only

- checkOne View single time view of the course content

- checkSix Months Validity of the course

Advanced

₹8723

Value of Money

- checkMobile, Tab, and Desktop access you can access your course on any Device

- checkUnlimited View watch your course unlimited times No-limit

- checkOne-Year Validity of the course

Exclusive

₹30,000

Life-Time Validity

- checkMobile, Tab, and Desktop access you can access your course on any Device

- checkUnlimited View watch your course unlimited times No-limit

- checkLife-Time Validity of the course

All rights are reserved |100% Satisfaction Guaranteed | We Protect Your Privacy

Marketed By:Digital Market AddA